Use Cases - 09.7.2024

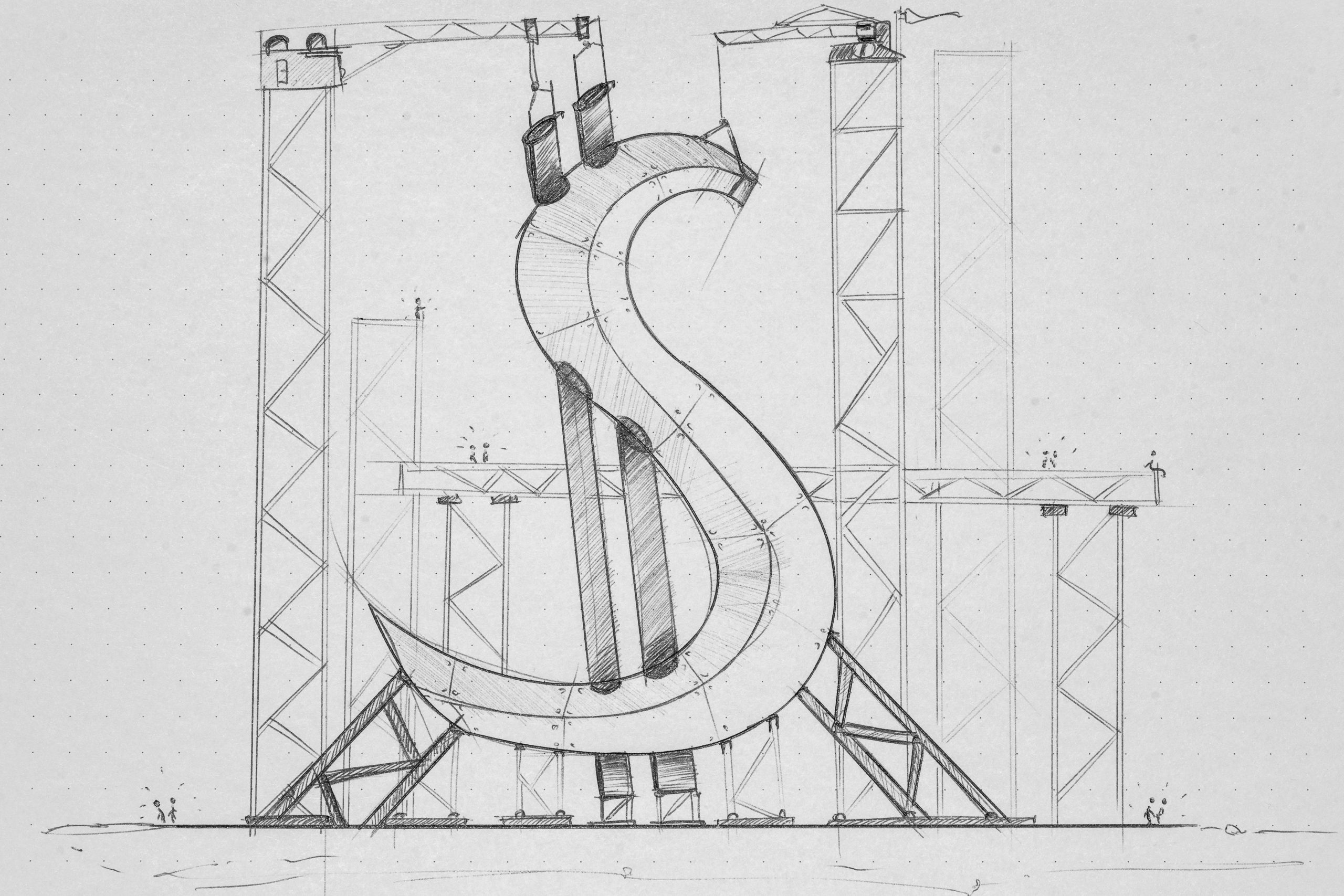

Financing a project

The successful realization of construction projects requires a well-thought-out financing strategy. COOR offers you a comprehensive overview and management tools for all financial requirements.

Imagine you’re facing the financial challenge of realizing a large neighborhood project. The right financing is crucial to turning your vision into reality. This is where our revenue controlling comes into play, particularly the cash-flow and financing plan functionalities.

With COOR, you always have a clear overview of your project’s financial requirements. Our revenue controlling module provides detailed information on the required capital, financial sources, utilization and repayment structure, as well as actual costs.

Cash-Flow management

You can precisely plan when and how much capital is needed to avoid bottlenecks and ensure liquidity. COOR visualizes your cash flows and helps you maintain financial stability.

Financing overview

Keep track of all financing sources and conditions. You’ll always know how much capital you have, when it’s available, and how efficiently it is used and repaid. Additionally, COOR allows you to actively manage and compare interest calculations.

Through this transparent and comprehensive financing overview, COOR enables profound decisions and supports you in successfully financing and implementing your project. Thus, your vision becomes reality – precise, calculable, and financially secured.

Benefits and advantages at a glance

- Precise capital planning: Accurate determination of capital needs and availability – when, how, and where

- Transparent cash-flow overview: Clear visualization of cash flows

- Comprehensive financing overview: Insight into financial sources and financing framework

- Profound decisions: Detailed insights for secure financial decisions – Go or No-Go